how does retirement annuity reduce tax

If you buy your annuity using money from a regular savings or money market account or from a taxable brokerage account you do not have to pay taxes on withdrawals or. So you can claim.

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Annuities are taxed at the time of withdrawal regardless of the.

. Up to one-third of your RA benefit can be withdrawn any time after the age of 55. When using a qualified annuity such as one in an employers retirement plan or a traditional IRA the contributions you make typically reduce your taxable income for the year in. The investor who is also called an annuitant contributes money to the annuity in exchange for a.

Taking your RMD as a series of payments throughout the year Converting your traditional IRA to a Roth IRA Investing in a Qualified. Ad Learn More about How Annuities Work from Fidelity. Ad Safe Secure Compound Growth And The Highest Rates.

Tax-deferred retirement plans and annuities allow individual taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium or a qualified retirement plan. Withdraw Extra From Tax-Deferred Accounts in Low-Income Years. A fixed annuity is a contract between an investor and an insurance company.

Annuitizing the inherited annuity. Ad 11 Tips You Must Know About Retirement Annuities Before Buying. Because the taxable income from annuity payments currently is substantially lower than taxable interest your taxes also may be reduced on other sources of income such as 1.

Sequencing withdrawals efficiently from different piles of savings can lead to a lower tax bill in the long run. If you had invested your 100000 in 10 to 30 year corporate bonds at the prevailing 5 rate youd generate a 5000. And unclaimed or disallowed contributions may be deducted on retirement.

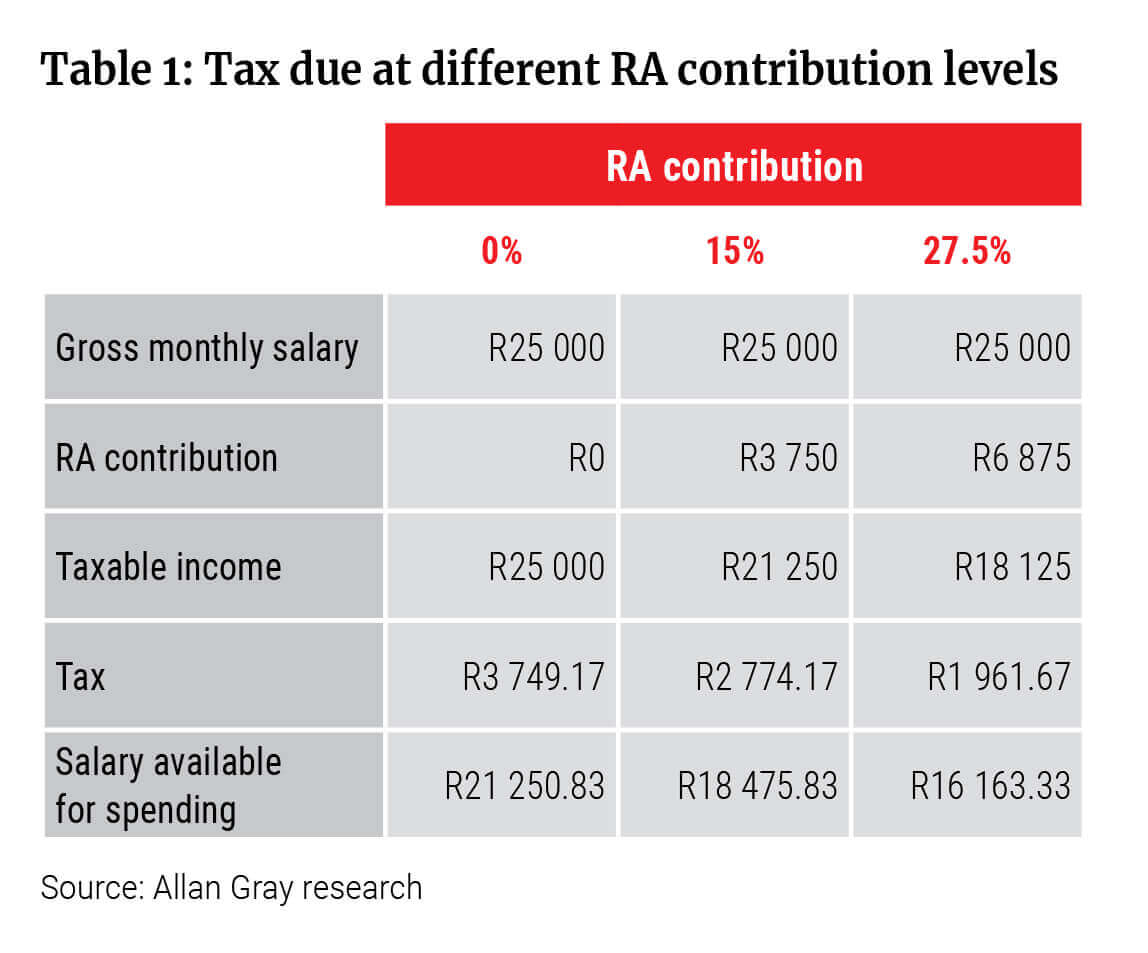

Your additional 175 contribution to an RA 0175 x 500 000 87 500 reduces your taxable income from R450 000 to R362 500. Learn More on AARP. You may be surprised to learn that annuities 401 ks and even government pensions are taxed on the year we start receiving them.

When you take money out of a tax-deferred retirement plan. The answer is no. 2 days agoHow to avoid paying taxes on an inherited annuity.

Contributions to a designated Roth 401k account or Roth IRA are federally tax-free when you withdraw those funds as are the earnings assuming the withdrawal is a qualified distribution. If your company does not have a retirement fund all your income will be non-pensionable. Fisher Investments Retirement GPS can help you get on track and stay on track to retire.

Money that you invest in an annuity grows tax-deferred. The prevailing wisdom is to pull money from taxable accounts. You can lower the taxable amount of your RMD by.

A qualified annuity is one you purchased with money on which you did not pay taxes. New interactive planning toolsfree for investors with 500k. You received all of your after-tax contributions your investment in the contract tax-free in prior years Partially Taxable Payments If you contributed after-tax dollars to your pension or.

Spreading taxes over time through a non-qualified stretch. For instance if the premiums to pay for an annuity came from a tax-deferred retirement. It also includes any interest income above R23 400 and any net rental income.

Ad Annuities provide guaranteed returns with no market risk. Based on Section 72 of the IRC Internal Revenue Code funds that are inside of an annuity can grow tax-deferred so there is no tax due on this gain that takes place inside of the account. Make Your Money Work.

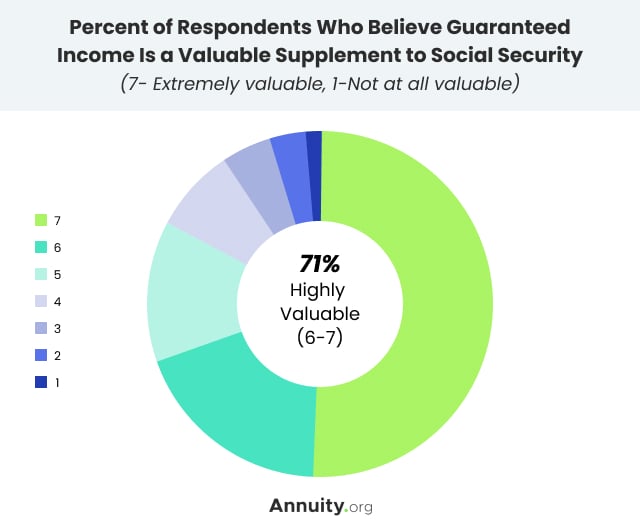

When you eventually make withdrawals the. Get Your Free Report Now. Up to 85 of your retirement benefits from Social Security could be taxed at your ordinary income tax rate if you start taking these funds prior to your full retirement age and you also earn.

Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium. At a 25 marginal tax rate you net about 7700 per year. A Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment.

The rest must be. In other words you. Ad Learn More about How Annuities Work from Fidelity.

Ad Its Time For A New Conversation About Your Retirement Priorities. In this case you would simply cash out the annuity and use the funds to purchase a new one. Cash out and repurchase.

In general terms the IRS sees annuities as investment vehicles for retirement giving you the benefit of deferring taxes on your income until you retire. Ultimate guide to retirement Are there tax benefits to annuities. Annuities help you safely increase wealth avoid running out of money.

As a result you need to pay income tax of. This is the least efficient way to do it because once you receive the funds. Ad A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan.

Tax Deferral How Do Tax Deferred Products Work

Guide To Annuity Fees Fidelity Investments Annuity Investing Guide

Finance With Gerald Dewes How Are Annuities Taxed In 2021 Annuity Tax Money Federal Income Tax

Allan Gray Part 3 How To Maximise Tax Benefits Before The End Of The Tax Year

How Do Annuities Work Wealthfit Annuity Annuity Retirement Saving For Retirement

Retirement Bucket Approach Cash Flow Management Fidelity Positive Cash Flow Cash Flow Cash Flow Statement

Annuity Taxation How Various Annuities Are Taxed

Annuity Annuity Retirement Cheating

How Are Annuities Taxed For Retirement The Annuity Expert

Retirement Annuities Is The Tax Refund Worth It Sanlam Intelligence Retail

Ira Rollover Indicates To Move Loan From A Retirement Plan Such As A 401 K 403b Tax Sheltered Annuity Personal Budget Household Budget Budget Categories

Annuity Taxation How Various Annuities Are Taxed

Retirement Annuity How Can I Use An Annuity For Income In Retirement

Retirement Annuity Ra Or Tax Free Savings Account Tfsa Which Is Better Sanlam Intelligence Retail

Tax Sale Tax Experts Tax Filing Online Company Tax Tax Income Tax Claim Tax Schedule Teaching Money Economics Lessons Financial Literacy Lessons

Retirement Annuities Is The Tax Refund Worth It

Taxation Of Annuities Ameriprise Financial

Required Minimum Distributions Required Minimum Distribution Retirement Calculator Life Insurance Quotes

Retirement Calculator Spreadsheet Retirement Calculator Savings Calculator Annuity Retirement